Introduction (Interest Rates Cuts)

The recent interest rates cuts by the Federal Reserve have stirred significant discussions globally, particularly in Singapore’s real estate sector. With the Fed lowering its policy rate to the 4.25%-4.50% range and signaling fewer cuts next year, the effects on mortgage rates, housing prices, and market sentiment in Singapore are becoming increasingly evident. This article explores the implications of these developments for buyers, sellers, and investors in Singapore’s property market.

The Fed’s Recent Policy Shift

The Federal Reserve’s decision to lower interest rates marks a cautious approach to combating persistent inflation. Fed Chair Jerome Powell emphasized the need for prudence, acknowledging that inflation has been slow to decline. Policymakers are also navigating economic uncertainties posed by the incoming Trump administration, which is expected to implement inflationary policies such as higher tariffs and tax cuts.

Key highlights of the Fed’s new outlook include:

- The policy rate is projected to remain elevated longer than anticipated, with only two rate cuts expected in 2025.

- Core inflation, measured by the Personal Consumption Expenditures (PCE) price index, is projected to hover at 2.5% through 2025, above the Fed’s 2% target.

This restrained monetary easing signals slower declines in borrowing costs, affecting global financial markets and interest rates, including those in Singapore.

Impact on Singapore’s Housing Market (Interest Rates Cuts)

Immediate Effects on Mortgage Rates

Singapore’s mortgage landscape is closely tied to the Singapore Overnight Rate Average (SORA), which responds to changes in the Fed rate. A decline in SORA results in lower monthly payments for homeowners with floating-rate loans. As of now, the three-month compounded SORA has decreased marginally, from 3.7% to 3.5% p.a. This benefits:

- Homeowners with floating-rate mortgages: Lower monthly payments improve affordability.

- Prospective buyers: Reduced borrowing costs enhance buying sentiment.

However, fixed-rate and HDB loans remain unaffected in the short term. Christine Sun, Chief Researcher at OrangeTee Group, noted that lower interest rates could prompt buyers to explore larger or more luxurious properties.

Long-Term Implications for Housing Prices

Historical data suggests a correlation between falling Fed rates and increased property sales. For instance, during the 2008 global financial crisis, declining SORA coincided with a surge in home sales. However, the current environment—characterized by tighter government regulations such as the Total Debt Servicing Ratio (TDSR) and Loan-to-Value (LTV) limits—mitigates the full impact of rate cuts on purchasing power.

Market experts predict that:

- Property prices will likely continue to rise, albeit at a moderated pace.

- Developers may remain cautious due to elevated interest rates and unsold inventory, as evidenced by the slow uptake of new condos and declining bid activity in government land sales (GLS).

Challenges and Opportunities for Stakeholders

Buyers

For potential homeowners, the environment presents both opportunities and challenges:

- Opportunities: Lower mortgage rates improve affordability, encouraging upgrades or investments in higher-value properties.

- Challenges: Stringent TDSR assessments and LTV ratios limit the maximum loan quantum, capping buying potential.

Sellers

Home sellers may experience increased interest from buyers encouraged by lower borrowing costs. However, the slower-than-expected drop in SORA may temper this enthusiasm.

Developers

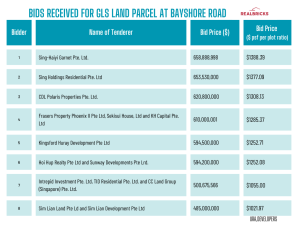

Developers are adopting a cautious stance. The Urban Redevelopment Authority (URA) has rejected bids for several GLS sites due to low offers, reflecting developers’ wariness. The slowdown in private home sales, coupled with elevated construction costs, adds further complexity to their outlook.

Forecast and Actionable Insights

- For Buyers: Leverage lower mortgage rates to explore refinancing options or upgrade to larger properties. However, assess affordability carefully, considering the MAS stress test rate of 4%.

- For Sellers: Highlight the affordability benefits of current market conditions to attract motivated buyers. Consider timing sales to capitalize on improving sentiment.

- For Developers: Monitor SORA trends and adjust strategies to target safer projects, such as those near MRT stations or in mature HDB estates. Focus on clearing unsold inventory before pursuing new developments.

Conclusion

The Fed’s rate cuts offer a mixed bag for Singapore’s real estate market. While declining interest rates boost sentiment and affordability, regulatory constraints and cautious market dynamics temper expectations. Stakeholders should navigate these conditions strategically, staying informed about global and local trends to make the most of emerging opportunities. As the landscape evolves, adaptability will be key to thriving in Singapore’s real estate market.